Financial Transparency Portal Story

GENERAL TRIAS CITY, Cavite -- Residents and business owners here can now pay their real property tax dues through debit, credit and prepaid cards "anytime, anywhere" online. This, after the city government of General Trias partnered with the Development Bank of the Philippines (DBP) to avail…

Himachal Pradesh Property Tax

General Trias Real Property Tax Payment. How to pay: 1. Magpa temperature check at sanitized sa entrance. 2. Pumila sa Kiosk para sa numero. Magantay tawagin para window 7 or 8. 3. Ipasa ang RPT Receipt nuon 2020. Note: tumaas ang value ng land, kaya tumaas ang tax. 4. Pumila sa Assesors Office para sa bagong Tax Declaration.

Megaworld to Build a Central Business District in General Trias, Cavite

GENERAL TRIAS, Cavite: To speed up the local government services of General Trias, the LGU launched an online payment service for business and real property taxes in collaboration with the Land Bank of the Philippines (Landbank). Mayor Luis 'Jon Jon' Ferrer 4th, Vice Mayor Jonas Labuguen, City Administrator Donna Jordan, City Treasurer Cecilia Prudente, Business Permit and Licensing Office.

Buyani

January 17, 2024. 130. GENERAL TRIAS CITY, Cavite: The local government here has launched the electronic business one-stop shop (eBOSS) to accelerate the process of tax payments. With the eBOSS, business owners can renew their integrated LGU permit (business permit, sanitary permit, and barangay business clearance) by scanning the QR code or.

BREA received multiple complaints over real property tax bills Eye Witness News

GENERAL TRIAS CITY, Cavite -- Residents and business owners here can now pay their real property tax dues through debit, credit and prepaid cards "anytime, anywhere" online.This, after the city government of General Trias partnered with the Development Bank of the Philippines (DBP).

BBMP Property Tax Online Payment 20222023 bbmptax.karnataka.gov.in

1st Quarter: On or before March 31. 2nd Quarter: On or before June 30. 3rd Quarter: On or before September 30. 4th Quarter: On or before December 31. Failure to pay on time will result in 2% of the unpaid amilyar amount per month with a maximum of 72% for 3 years (36 months). After 3 years, the LGU may auction your property.

Antipolo City Online Services How to pay Real Property Tax (RPT) online Online Quick Guide

In this video, we will show you one of the easiest ways of paying amilyar or real property tax. No more hassle, no more lines, just use your GCash App to pay.

JEC Accounting, Auditing, Tax Services & Business Consultancy General Trias

Pay the amount as indicated in the Assessment Record. Approved applications will be sent a billing of the summary of taxes, fees & charges through email and text; Payment must be made using any of these payment facilities: STEP 3 PICK UP. Pick-up or Delivery of Mayor's Permit. After payment has been made, an email and text message will be sent.

About Us Division of General Trias City

Taxes can also be paid conveniently at the City Treasurer's Office Tax Payment Center located at the General Trias Cultural and Convention Center, Barangay Sampalucan, near the Public Market from January 4 to February 29, from 8 a.m. to 5 p.m., Mondays to Fridays (except on holidays).

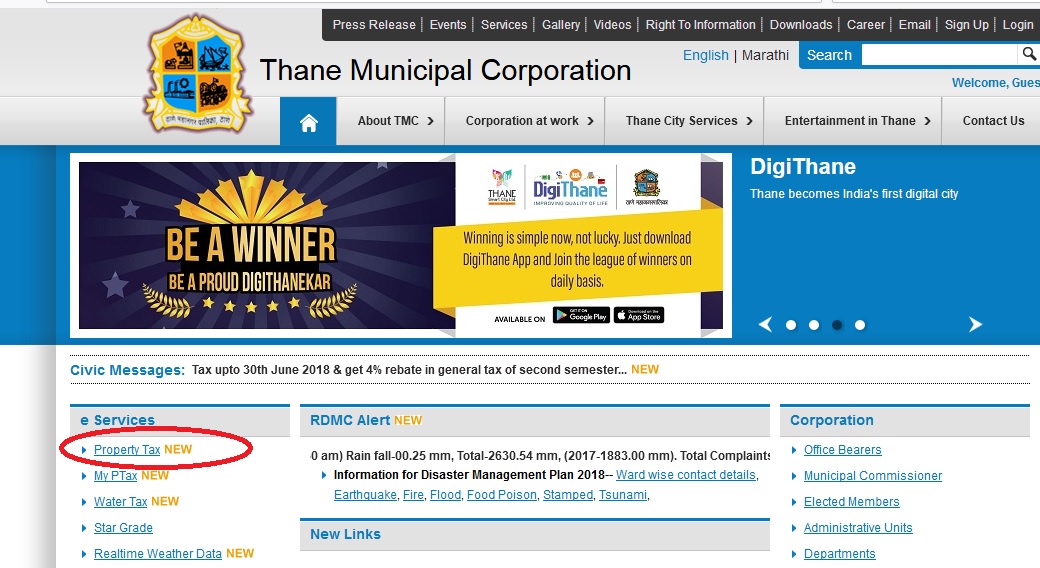

Property Tax Online Payment Thane, Municipal Corporation, Online Guide

#amilyarpayment #realpropertytax #generaltrias #municipalhall #trecemartires #caviteREAL PROPERTY TAX PAYMENT GEN. TRIAS CAVITEVISIT ONE PINOY'S HYDROPONICS.

REAL PROPERTY TAX PAYMENT GEN. TRIAS CAVITE🏠 VLOG10 YouTube

General Emilio Aguinaldo Hospital Barangay Luciano, Trece Martires City (046) 419-0123 pho@cavite.gov.ph Contact Information MA. KAREN B. CAMAÑAG-TUPAS OIC -PROVINCIAL HOUSING DEVELOPMENT & MANAGEMENT OFFICE. Real Property Payment; Real Property Tax Clearance; Quarry Resource Tax;

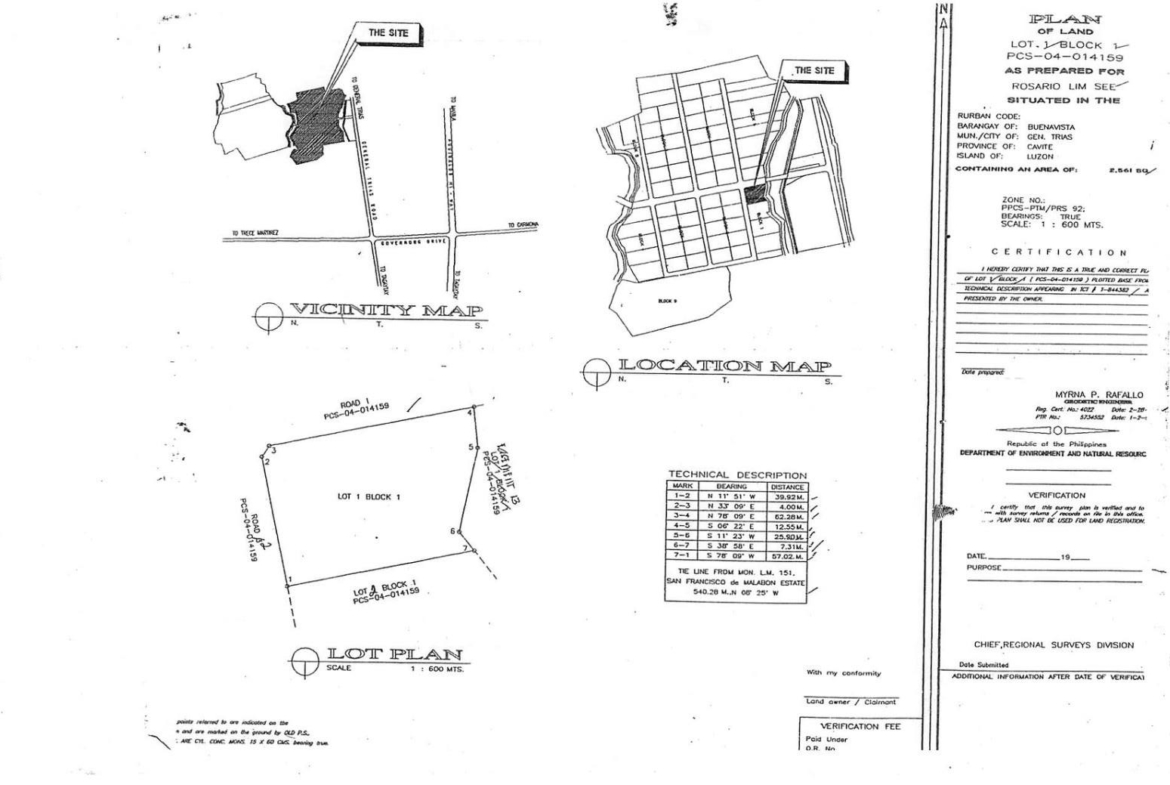

14K Sqm Industrial Lot For Lease, General Trias, Cavite

In general, the assessment of real property tax follows this formula: Real Property Tax = Rate x Assessed Value. For instance, if your property is in Metro Manila and the assessed value is ₱1,000,000, your real property tax will be: ₱1,000,000 x 2% = ₱20,000. However, if your property of the same value is located in the province, your.

How to Estimate Commercial Real Estate Property Taxes FNRP

"With the POS facility, residents and business owners in General Trias City can now pay their real property taxes using debit, credit and prepaid cards, while the IPG would facilitate online acceptance of payments of the taxpayers' real property and business dues," Borromeo said.. General Trias city mayor Antonio A. Ferrer said the.

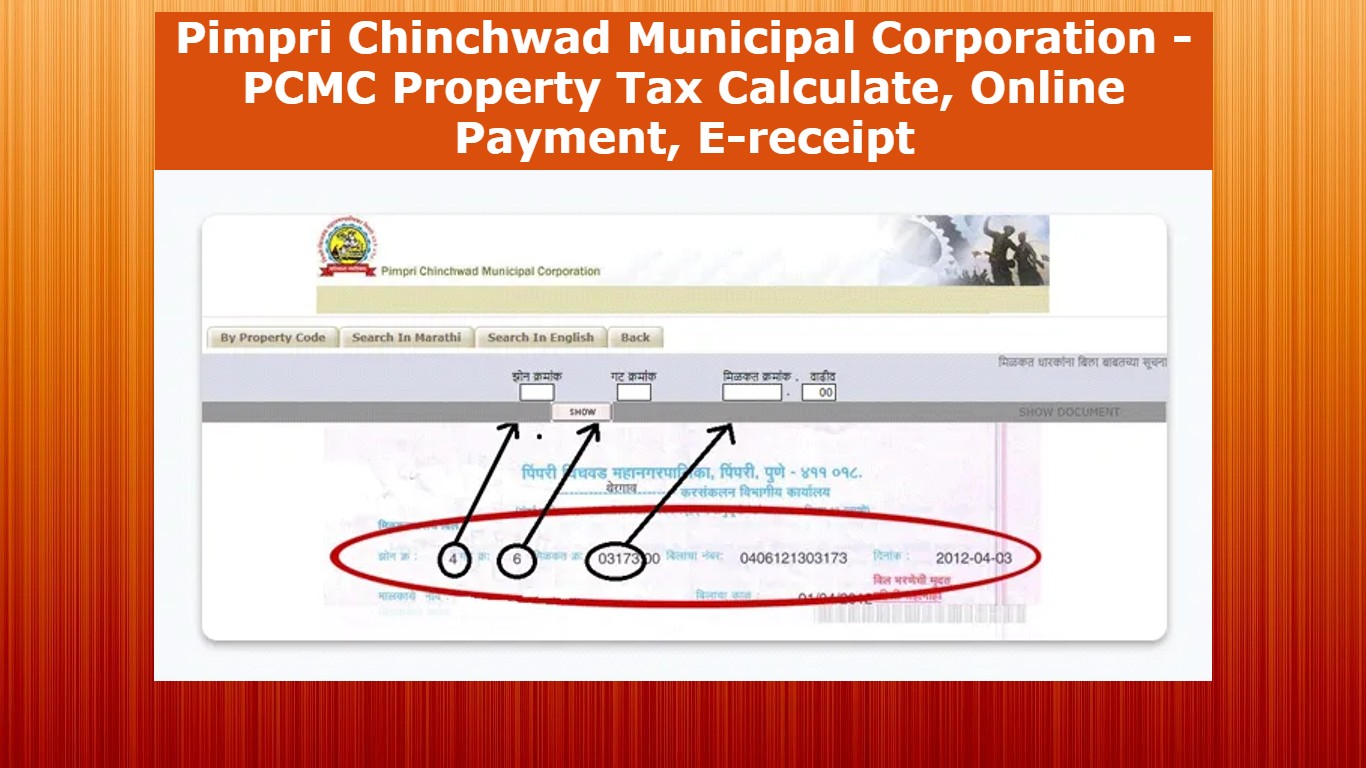

Pimpri Chinchwad Municipal Corporation PCMC Property Tax Calculate, Online Payment, Ereceipt

What is real estate property tax? Real estate property tax is a tax imposed by your Local Government Unit that property owners must pay annually. Taxable properties include land, building, improvements on the land and/or building, and machinery. 2.

Tanauan EServices

For that reason, the airSlate SignNow online application is important for filling out and putting your signature on dasmariñas real property tax online payment on the go. In a matter of moments, get an e- paper with a court-admissible signature. Get general trias real property tax online payment signed from your smartphone using these six steps:

do you pay property tax if you rent

GENERAL TRIAS CITY, Cavite — In speeding up local government services, General Trias launched an online payment service for business and real property taxes in collaboration with Land Bank of the Philippines. Mayor Luis 'Jon Jon' Ferrer IV, Vice Mayor Jonas Labuguen, City admin Atty. Donna Jordan, City Treasurer Ceciile Prudente, Business Permit and Licensing Office head Romel Olimpo and.